A long time ago (OK, 2010), the DOM and Order Flow were barely discussed in trading. Most platforms had a DOM, but they were featureless skeletal creatures with very little meat on them. Educators like John Grady at NO BS were amongst a handful of players that took a lead in teaching people the DOM, and we played our own part starting 2012 bringing in features that made reading the DOM more accessible to those of us with Goldfish-like memories.

As Order Flow became more popular, we saw more and more players gravitating towards DOM trading - some with cool and innovative takes on it, some with more questionable techniques. In this article, we’ll do a quick sanity-check, so we understand what works and what doesn't - at least conceptually.

Front Running

Front Running is one example of the “curse of the new DOM Trader” - which often involves throwing everything you know about trading away and looking to trade a "1 rule trading system". That's our name for any approach to trading that is based on a single rule.

So what is front-running? Can you make it work?

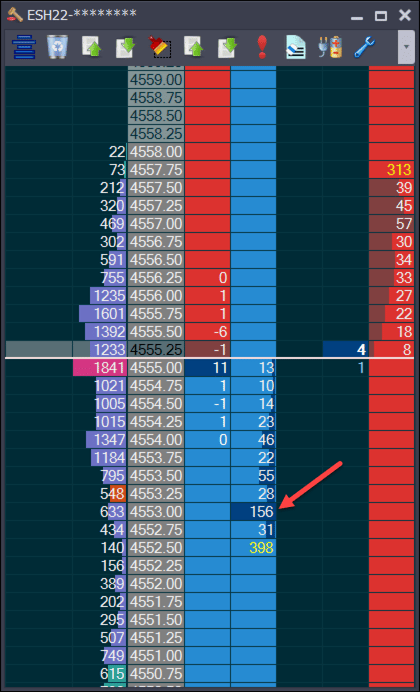

In this image, we can see a large bid where the red arrow is at 4553.00. Front running would involve placing an order at 4553.25. The theory is that if this order is real, it'll hold the market and so if you place an order in front of it - you'll benefit from them holding the market.

In this image, we can see a large bid where the red arrow is at 4553.00. Front running would involve placing an order at 4553.25. The theory is that if this order is real, it'll hold the market and so if you place an order in front of it - you'll benefit from them holding the market.

So, there's your 1 rule - "if you see a really big order, place an order 1 price in front of it".

And this is very nice of the trader with the big order - putting it there so we can see it and get a better price than them.

Lovely!

Only 1 minor issue - it doesn't work. BUT it would be great if it did. No need to learn how the markets work, no need to understand what hits the market, no need to hone your skills, no need to know if the market is in a trend or a range. Just 1 rule.

A monkey could do it.

Thankfully, trading isn't that simple. If it was, everyone could do it, and we'd have nobody to lose when we won. But it doesn't mean this 1 rule can't be a part of a more nuanced trading strategy, so let's consider some other things we could consider:

- Only take the trade when markets are slow and lazy, lacking overall direction.

- Look for the orders at 4553.25 and 4553.50 to increase as we move to the price - others front running the order is a good sign.

- Do not take the trade if orders disappear as we get close to that price. Note - you might want to put in your order early for queue position but pull it if they pull.

- Don't take the trade in the first 30 minutes, or close to a news release.

- Consider taking the trade after 4553.00 holds

- Consider taking the trade only if the 156 orders at 4553 get traded and increase as people trade into it (iceberg order).

We are now considering what that large order may represent and looking for clues to confirm or reject our hypothesis. Like many trades - sometimes it will be clear, and sometimes it won't. Take any setup and sometimes it will be a slam-dunk, while other it'll be a little murky. The more frequently you take this trade, the better you will get at it. This trade will be different in thinner markets too - as it's more common to jump to the order, trade it, hit the next price and then reverse. So, we'd go through 4553, trading the full 156, then hit 4552.75 before moving back up.

You should not be put off by this nuanced approach. It's what separates the men from the boys in trading. This nuance is really what trading is all about - seeing patterns and exploiting them - but patterns don't have to be "charts" or "shapes" like head and shoulders. In trading, a pattern would be better described as a "sequence of events" that recurs frequently.

Fading Absorption

Front running isn't the only "1 rule trading system" either - another popular one is "fading absorption" - absorption is when a lot of orders hit a price but can't make headway. So buying that can't move price up or selling that can't move price down. It's often the end of a move. But absorption can happen in the middle of a move as well. On it's own, absorption is not enough - but if you combine it, it can be a significant part of the story/sequence of events:

- A - The white horizontal line is an area of exceptionally large offers that have been there a while - we don't want to front run them just because they are there.

- B - The market spikes up - you can see that long green bar as we head into the level with large offers.

- C - The "balls" - these 3 over layered "balls" (for want of a better word) are mostly blue. These appear when a lot of volume appears at a level, the size shows relative volume (bigger = more volume) and the color signifies side (blue for buying, red for selling) - so we see a lot of trades, mostly buy side initiating and the price is not moving their way. The buying is being absorbed.

Now - these 3 things didn't all occur at the same time. We saw the large offers for over 15 minutes, the spike up took a very short time (less than 10 seconds) - and the massive size that traded there was done in about 20 seconds. The large offers gave us a heads-up. The spike up and the absorption completed the sequence of events.

Is that a guaranteed trade? Absolutely not. Is the risk small? Absolutely. This is either the end of the move or it isn't. You don't need to give it a chance to go far past the blue balls. Now - would you take the trade if employment numbers were due out in 2 minutes? No - that's another part of the story that's playing out - but in the absence of news, it is a very interesting sequence.

And the sequence is key. One event alone - it's attractive but not realistic. A sequence of events - this is what the good traders are looking for. Note also - the sequence doesn't stop once you get into the market.

But that's for another article.