Well - here we are again almost two weeks into another major shift in volatility, both in Crude Oil and in the US Indices. For those of you new to trading, you may well be wondering how long it will last and what you can do about it.

The Financial Media

Perhaps the most important thing you can do at this time is not let the media influence your trading decisions. There's two sides to that. Fear and greed.

On the fear side are all the "sky is falling" reports in the media. These people love a bloodbath to report on and they will bring on the 'pundits' with the most extreme bearish views. On the China side, the CSI300 index that has 'crashed' has actually only gone back to the levels it was at the start of this year. US indices dipped to their October 2014 levels. Both indices have had big moves up and in the case of China it almost doubled this year. Honestly, if the market goes up 2 days in a row, you'll be hearing "new Bull Market" from all the pundits.

On the greed side, and certainly the more dangerous side are stories like this one - "While many panicked, Japanese Day Trader makes $34 Million" I get a little disappointed when I read articles like this. They tend to boil day trading down to some sort of "arcade game" and it's quite likely that more than a few novice day traders looked at that, got all excited about the opportunity and wiped out.

The Technicals

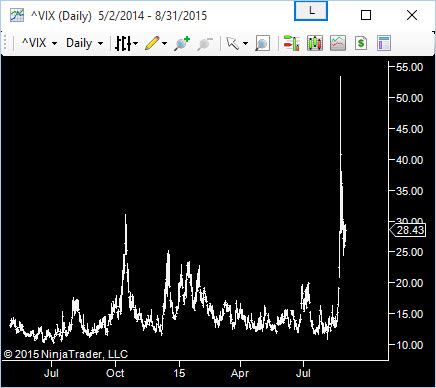

Technically speaking, there are reasons for the increase in volatility and that means that you will be able to look for signs that it's calming down. The first one is the CBOE Volatility Index aka the VIX. To cut a long story short it is a measure of expectation of future short term volatility.

My opinions on the VIX are fairly well known; that when it moves above 24 or so, we see a big reduction in liquidity. By liquidity I mean limit orders on the DOM. So if the VIX is at a healthy 14, we will probably see 800-1500 contracts at each level on the DOM on the eMini S&P500 (ES).

That higher level of liquidity means a few things. It takes more market orders to "eat" through the liquidity at each price. It therefore takes longer to move through prices, the market is more orderly and we have more time to make an informed decision about where to place our trades.

We often hear how "HFTs provide much needed liquidity in the markets" and again, when they say liquidity, they mean limit orders. Of course HFTs do provide liquidity - until times like this when we actually need it and then they basically disappear. Naturally Market Makers also back off at these times.

So we have an increase in volume because lots of people are panicking right now and we have a decrease in volatility-reducing liquidity that would help to slow the market down. So basically, the US indices are all over the place. Instead of 800 contracts per level on the ES, we have 100, 30, 200.

How to play it?

When you day trade a Futures market, you are doing a couple of things. You are to some extent trading the fundamentals of the underlying market. Mostly though you are playing against other speculators. The behavior and impact of other speculators depends very much on the level of liquidity there. So if you take a market like Crude with 100 or less contracts per level on the DOM, it will be more volatile than the ES with 800 per level.

Another way to put this, if you are trading a market that usually has 800 contracts per level and now it has 200 contracts - it will behave differently. You have 2 options in this situation.

- Try to trade the market with the reduced liquidity, with wider stops, even though it will behave differently.

- Look for another market with the level of volatility you are used to trading. It will likely exhibit the type of behavior you are used to trading.

For someone that trades the ES like me, the 30 year US Treasury Bond Futures is a much better market to play in terms of volatility and liquidity. Certainly if you are new to Order Flow, it makes sense to focus on a market like that than the extremely volatile ES. It's not the only market to look at, just an example of one more orderly market to trade right now.

As we get back to normal (and we will), the VIX will come down and the HFTs and Market Makers liquidity will comes back. Then I'll be moving back to the ES as I still like the market, I just don't like it like this.

For those new to order flow, it's much better to build your skills on a slower market first. So if you are trying to learn order flow on the ES and struggling. It's not your fault.