Increased market volatility should lead to increased profits from larger moves in the market. For most traders though, the opposite is true and it leads to increased losses. This article presents a rational approach to handling increased volatility.

We've gotten past labor day and usually that's a time for reflection on how the market volatility will switch gears. This year is a little different to most, so let's first consider why we'd expect a change at this point, then we'll look at how to approach these markets moving forward. Traditionally, the markets over the summer are slow and lacking interest. There's 2 reasons for this:

- Lots of people are on vacation.

- Liquidity increases as market makers risk is lowered (so more bids/offers per price).

- It's expected, so it becomes a self-fulfilling prophecy - so more people disappear on holiday in anticipation of others doing the same.

This impacts markets across the board most years. The markets then start to return to normal after US Labor Day (which was this Monday) and are back to normal by the Monday following Labor day. This summer, there was no slowdown. Quite the opposite, we encountered extreme market volatility. This hit most markets but let's focus on the S&P Futures:

There's a few things worth noting here. First of all - the markets really went nowhere in August. It's one big sideways range, which IS typical of a summer market. The next thing worth noting is the volume. Most days were close to 2 million contracts and we hit 3 million on a couple of days. We'd expect volumes well below a million contracts in typical summer trading conditions. Finally the ATR ("Average True Range" at the bottom of the chart that's simply the average number of points moved per day) hit 50 points, that's exceptional. A typical summer slowdown will see days well below 10 points range. The smallest I can recall is 3.5 points move in a day. It's painful and slow and the reason I took August off this year from trading, because it's normally like watching paint dry.

It's not hard to understand the reasons for this increase in market volatility. There's a lot of high impact news at the moment and the inevitable knee-jerk reactions from the market. The main ones being:

- Trump - specifically his trade war with China. Trump was always going to be a good president for day traders because of his boisterous 'in your face' style and his direct communications via Twitter. He's a one man volatility machine.

- Brexit - An ongoing farce which never seems to get closer to resolution but where the market still takes the last 'news' as if it's going to be the final outcome. As late as yesterday, some people walked to the other side of a room in London and Sterling rose off the back of it. It's a great insight into the way the market reacts to news. It's the opposite of the "Boy who cried wolf". It's as if the market is Forrest Gump and has no recollection of the fact that things it reacted to before on Brexit never resulted in any outcome either.

- Recession - The media is talking up the idea that we are in a recession. It's great news as it's fear based, we are now more reactive to numbers that appear bad. So we should expect better moves based off any economic releases that are negative in outlook

This isn't all that's going on too but this is the main focus right now. August saw massive volume, big moves but ultimately going nowhere. It all comes down to the nature of the markets. In this mode, they are much more vehicles for speculation than some sort of 'valuation machine' that's taking a rational assessment of the markets. There's lots of traders poised at economic release times and all they want to do is ride that momentum move generated for a profit. It's a huge crowd of people jumping into the markets to take advantage of a move. In fact - it's this huge crowd jumping in that causes the move in the first place. Chicken, meet egg.

So what can we expect as the bleary eyed traders return from their vacations? Well, this is a unique situation, so I don't believe anyone has the answer. I'm set for a continuation of August market volatility.That means the continuation of a lot of news-driven, volatile days. This presents a problem for most technical traders. In the absence of news, markets are somewhat predictable in that they trade a certain way. With news driven markets, the action is different, market makers play it differently, HFTs play it differently. As a trader, you know that the moves will often be sustained but you also know that the market can snap back a considerable amount yet still be heading your way. My opinion is that traders should consider the following adjustments

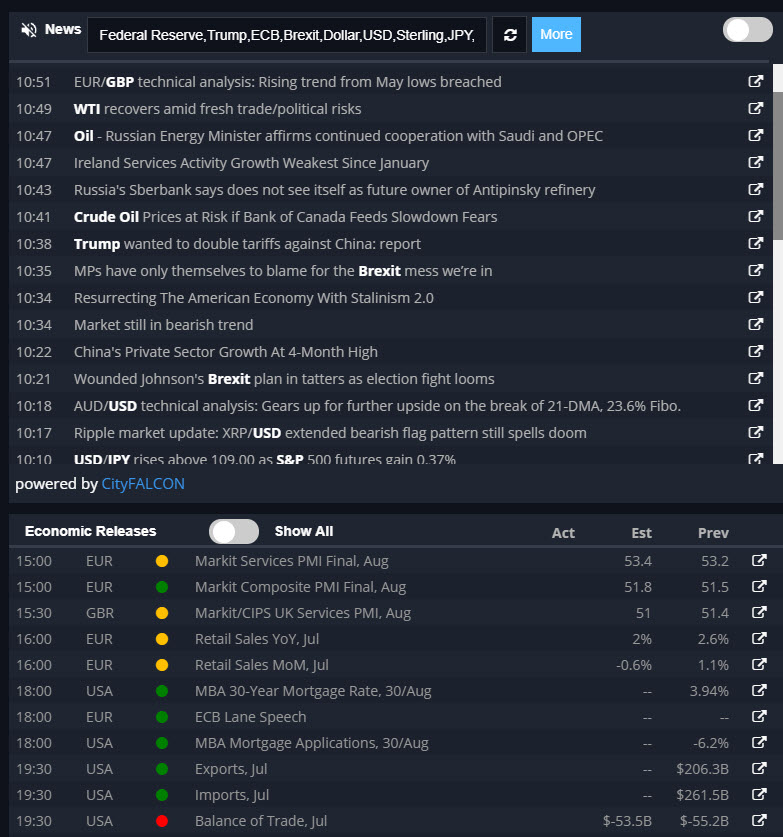

Become News Aware - If you aren't already looking at the news before you trade and keeping an eye on it intra-day - you should do this now. If there's big news moving the markets before you trade, then don't expect normal market behavior or for your 'normal market' setups to work. You need to be aware of upcoming economic releases and also to have an eye/ear on a news squawk. This isn't about trading the news necessarily, it's about being aware of what the market is reacting to. If you see a sudden move during the day, you want to be able to quickly assess if some recent news is pushing the market in a new direction.Yes, this will take up some screen real-estate and a lot of traders like to fill their screens with charts but at all of the prop firms I've been to - they dedicate considerable space to their various news feeds.

Move To A Thicker Market - This is one way to adjust for the volatility. The behavior of any particular market is a result of the volume and liquidity on that market. The liquidity dictates how much volume it takes for price to move. This gives each market a 'personality'. As all markets increase in pace, then your market will change personality and potentially put you outside of your comfort zone as a trader. For example, you may not be able to tolerate the wider stops or it may simply become too fast for you to read it. When the market shifts personality, you get an overall feeling that you have no clue what's going on and this often gives leads traders to conclude there is a problem with their technique. On the contrary, the way you read the market may be fine but the market has become so thin and volatile that your techniques no longer apply there temporarily. In this case a move from Nasdaq to S&P, or from S&P to interest rates could put you back in your comfort zone.

Trade Micro Contracts - If you have been pushed outside of your comfort zone from a risk perspective because wider stops are needed for your approach, then you can trade fewer contracts or move to a micro version of your contract. Analysis would still be done based on the regular contract but the micro contract would allow a wider stop without additional monetary risk. If you stay outside your comfort zone from a risk perspective, you are likely to make very bad decisions.

Scale In - As moves are bigger in this environment, scaling in is a great way to de-risk. Start small and build a position as the move is confirmed. Manage your average price so that it doesn't stay too close to the current price to build a buffer and try to maintain that buffer as it moves. In other words, don't add contracts every 2 ticks move. This way, you can have a few attempts to get into a move, get in small & scratch if it doesn't look good, you can do this a few times knowing that when you do catch a move, the result will make up for those scratches/small losses. This allows you to have a lower win rate, yet still profit overall.

Get in Later - Again, as moves are larger, you don't need to get in at precise price points. Volatile markets tend to slip and slide past prices even if they hold. I'm not a fan of precise entry points anyway but with the additional moves, you can let any reversal/break prove itself before you get in on one of the inevitable "whips back" the market volatility will give you. Letting the move confirm itself is part 1 and then letting the market pull back to give you an optimal entry price is part 2. You can do one or both, I prefer to wait for a good price, all part of trying to maintain that buffer but it's not mandatory.

In effect, what you want to do is stay in your comfort zone and play the market volatility to your advantage. Just think about how the market volatility has changed and what that means both in terms of risk AND opportunity. Make the adjustments you feel will best let you take advantage of these conditions. If you just try to apply the same techniques that worked before this heavily news-reactive environment, then you'll be very lucky to see that pay off.