This has so far, been an unusual week in the markets.

Typically, the first 2 weeks of the year are poor to trade. Volumes are normally to the low side and it can be fairly tight.

What we actually saw was the opposite. Volume and Volatility have been high.

Here was my prep for Monday - low expectations: https://www.topsteptrader.com/blog/s-p-futures-daily-pre-market-prep-and-levels-1-5

Here was my prep for Tuesday (yesterday): https://www.topsteptrader.com/blog/s-p-futures-daily-pre-market-prep-and-levels-1-6

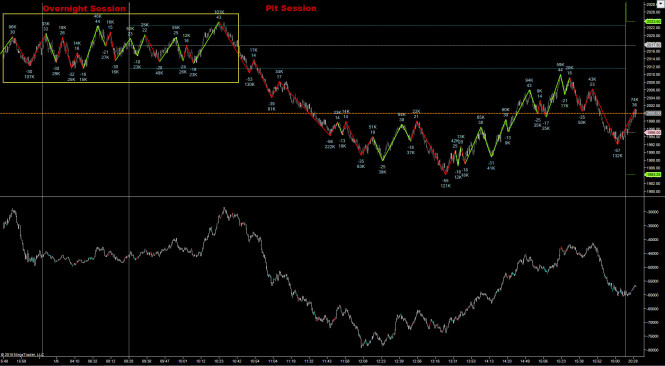

What we got yesterday on the eMini S&P500 (ES) was this (click to enlarge):

Overnight, we got stuck in the range we'd marked out the prior afternoon. The same thing happened for the first hour of the day until we finally broke down. Nothing unusual about that.

What IS unusual is the size of the swings. Moving 20-40 ticks in one fluid movement with little pullback in the ES is unusual. If you look at Monday, the swing sizes there are extreme too. This is similar to the activity we had in December.

Which brings us to the point. Whether you are trading Gold, Crude, Forex, Indices or Treasuries, what is it you are actually trading?

- You are trading the characteristics of that market

- You are trading against the other participants in that market

- You are trading against other short term speculators in that market

- You are sometimes piggybacking large moves because of major re-positioning

- You are relying somewhat on Market Makers in that market to behave in a certain way

So what do you do when the characteristics of that market changes from 'the norm' as we saw in late December and now in early January? When the amount of participation (volume) changes? When Market Makers run for the hills because it's a bit too risky for them?

You can do one of two things. You can adjust OR you can switch to a market that has the behavior you are used to trading.

Crude traders are people that like fast paced markets. When Crude slows down, those traders may struggle, they are no longer in their comfort zone. Moving to a market that has the pace and participation they are used to makes more sense than trying to become a different type of trader.

For those trading the ES, this additional volatility means that you have less time to make a decision, you will be stopped out more and you will be putting orders in and seeing the market move away from them (in your direction) without getting a fill. That of course, presuming that you aren't making serious adjustments for the volatility.

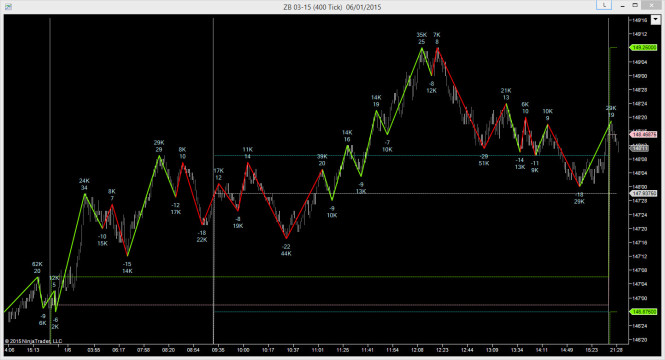

For ES Traders looking for the sort of conditions they are used to trading we have a few options. We can look at the EuroStoxx 50 (FESX). That tends to be thicker than the ES but right now, that looks volatile too. US Treasuries tend to be much slower than the ES. If we take a look at the US Treasury Bonds (ZB) and the 10 Year Notes (ZN) they are also more volatile than normal. The action there, in terms of swing sizes and volume looks more the sort of market conditions an ES Trader would be used to.

10 Year Notes

US Treasury Bonds

For ES Traders, you may find that these markets are more like the ES than the ES is right now.

What about beginners?

For the order flow veterans, you can see that these conditions present a challenge. The price action and the order flow are not what you are used to. You are missing out on trades because the market is so much faster than you are used to. Even chasing a trade when you miss a fill is problematic because it's moving 4-5 ticks off an inflection point very quickly. For the veterans, it's easy to stand to one side or just get in with a larger stop and track the flow after your entry to manage to the trade. The veterans advantage is that they know it's different right from the start of the day. It's fairly clear and so getting caught out by it is unlikely.

For those new to Order Flow and with a long term focus of trading a thicker market like the ES, it makes a lot more sense look at a slower market, especially if you are just going through the learning process. The ZN and ZB currently look like the best 2 markets to do that.

Will it be this way forever?

The markets tend to shift up and down gears regularly. In 3 months time you may well be reading a post about how the markets are crawling very slowly and which markets are in the 'sweet spot' right now.

Recognizing and adjusting to volatility changes are skills you will develop over time. It's always good to have an overview of the markets though as changes in one area tend to have a ripple effect to other markets. If you find yourself looking around for a different market to look at when volatility changes, this page on the CME Website is a good place to start.