It's summer time again and that means ice cream, sun burn and awful summer market trading conditions. Many of you will be experiencing your first exposure to summer market dynamics this year. In this article, we'll go over how to handle this as a new or experienced trader.

But first - are we really experiencing the dreaded "Summer market chop" right now?

Typically, the summer market dynamics kick in and we see a significant reduction in volume and volatility. This lasts till the week after US Labor day weekend, which this year is September 2nd. The following week then - September 7th is when normal volatility would resume after a summer slowdown - and that feels a long way away. This is by no means guaranteed, we have had years where there was no slowdown at all (like 2017) and we have had years when it slowed down so much, the range on the S&P moved as little as 3.5 points in a day.

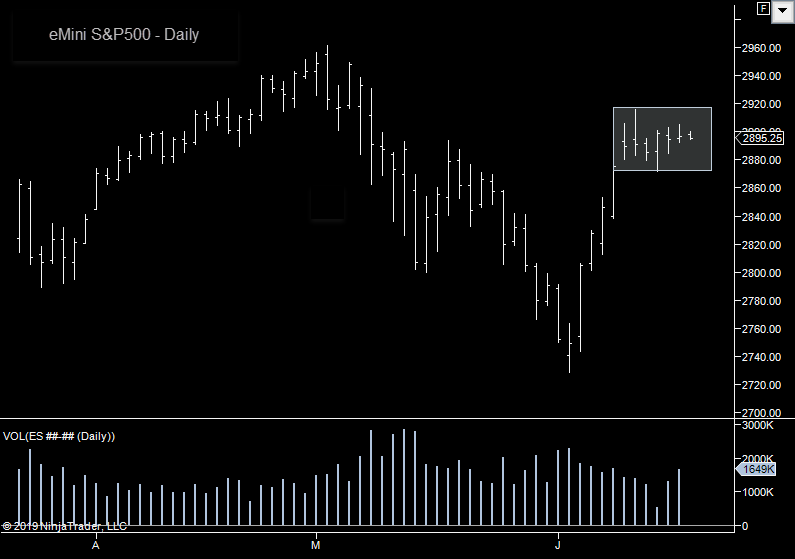

We do seem to have slowed down already, which to me feels a bit early but this isn't hard science. Markets have been directionless for the last 7 sessions BUT I think calling this a ' summer slowdown' is jumping to conclusions. If you look a the run down we had in May and the recent run up - we had some very big days. The past 7 trading days have really just been small relative to that. Volume yesterday was 1.6 million in the eMini S&P and it's been way over a million even during these 7 'sideways' days. Typically, it's when volume dips below a million contracts a day on the eMini S&P that we see poor summer conditions.

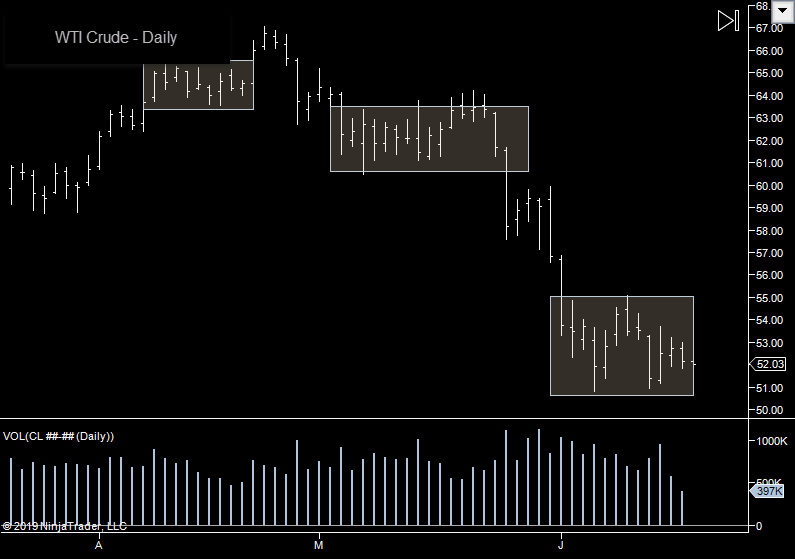

Other instruments like Crude have also exhibited a narrow range:

But if you consider the volume and previous ranges on Crude, this doesn't look like a large part of the market is now at the beach. It just looks like we have reverted to a period of temporary indecision.

Yesterday, the range on the eMini S&P Futures (including overnight) was over 22 points. To me, this is not summer market chop. I do agree that what we have seen in the past couple of weeks has been some tough trading conditions - I just don't think this is anything to do with seasonality. It looks to me like the market is taking a breather/indecision and settled into a temporary range. That's quite normal and not surprising considering that 200 point drop and subsequent recovery. In short, I don't think it's time to pack your swimming trunks just yet!

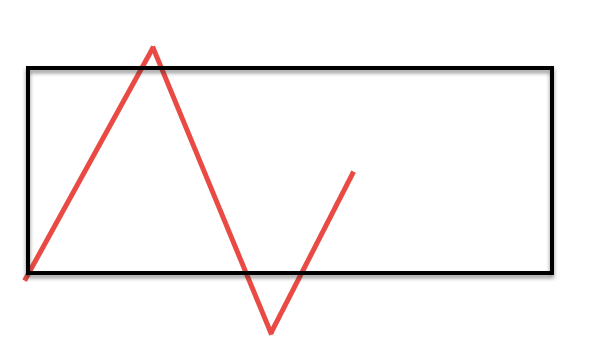

In the past few weeks, what we've been seeing a lot of is this:

Again, I'm referring to the eMini S&P500 futures. Market is often opening, putting in a few fairly nice swings in the first 20-30 minutes and then moving back into the range. From that point until the eventual break, it's quite treacherous. The black box area above is proving to be a really tough trade, with really directionless action. It's certainly choppy and indecisive but no worse than any other short term range. I think the recent volatility has spoiled us in many ways and we need to adjust back to what is normal - don't mess around in the middle of a range.

Summer Survival Kit

When the summer conditions do kick in, it's going to be far lower volume than what we have seen in the past 2 weeks. At that point, you need your summer trading survival kit. This comprises of:

Understanding Your Volatility Profile - When you find a market that fits you, it's generally because the volatility profile is such that it suits your personality. Not too slow, not too fast. For some that's the DAX, for some it's Crude, for some it's S&P and for others it's interest rates. This volatility profile is simply a product of the amount of volume trading and the liquidity available. In summer, the volume goes down and liquidity goes up (that's a whole other discussion, so just go with me on that). When your market slows down in the summer, they others tend to do so as well. You can often find the conditions you enjoy in a market that is traditionally too fast for you. So from interest rates you might go to S&P, from S&P you might go to Crude, from Crude you might go to Nasdaq, from Nasdaq you might go to DAX. From DAX - well, from DAX you are pretty much stuck! You get the idea. The conditions you like might not be there in your chosen market but they should be found somewhere else - grains, meats, metals, currency futures - there's a lot of markets out there.

News, News, News - Markets are driven by news and this summer, it looks like we are set to get lots of it. There's talk of the markets officially being in recession and a potential interest rate cut. Someone seems to be playing Battleships in the Middle East. Trump is.... well Trump is just a never ending source of market volatility, we are never more than a tweet away. Eyes on the Trade War as that was has been very fruitful this year. Brexit too - we can expect that to heat up again once the UK has a new PM and I dare say that if it's Boris, we'll see plenty of "foot in the mouth" situations which could also be good for volatility. Every day, you need to be news-aware, so that you are able to anticipate volatility that will come as a result of such news. Normally, you don't need to anticipate all that much because the volatility often kicks in overnight and carries into the day session. If you don't stay news aware than at best you will miss the days where volatility briefly returns to normal and at worse, you will get taken out trading the wrong market/style because everyone knows something that you don't.

Mean Reversion - When markets do slow down, mean reversion strategies tend to do well. As the market settles into very small ranges, it brings in new opportunities to play those ranges. In fact, it becomes the only game in town for many. Trying to make markets/scalp in the middle is a tough game and best left to those well versed in those skills. On the other hand, picking an extreme isn't hard and if you can focus on good R:R scenarios, getting a good price and not chasing trades, then it's a good 'bread & butter' trade for the patient. On entry, you need a strong conviction that the range extreme (or a failed break) is holding, that your entry is at a very favorable price and that your downside is capped. It's not just taking every extreme, it's taking every extreme that allows you to be wrong 50% of the time and still come out ahead.

Be Prepared to Not Trade - Probably the most essential skill during summer market trading conditions. The ability to not trade. I personally repeat the mantra "I don't actually need to take a trade" 3 times when I sit down to trade each day. This has been said enough in other articles for me not to dwell on it - but just don't throw good money at a bad market. Obviously, you don't want to sit at your desk for 8 hours without taking a trade, it's more practical to have a reasonable 'news aware' cut-off time each day. For example, if you trade crude, that might be 10-10:30 am EST except on oil inventories days when you wait for the number to see if that kicks off some volatility. If you trade interest rates, you might have the same cut-off but come back at 2pm ready for FOMC on those days.

The poorest plan during a REAL summer market slowdown is to simply forge ahead and attempt to apply the same strategies you were using leading up to the summer. Chances are, they won't work and the summer will be both frustrating and damaging to your account.

For more on summer trading - check out the summer trading section of the Jigsaw Blog.