Like many, I've been watching the shenanigans over trading in the stocks of GameStop with interest. I'd meant to pen an article on short selling for a while - but what better time than now?

For those unaware with the story, it's played out like this:

A while back, RobinHood (soon to be renamed Robbing Bas****s) launched a brokerage "for the people", offering free stock trading to all. This pretty much forced all US stock brokerages to do the same thing. Despite this, RobinHood were not a registered charity.... It brings a tear to my eyes.

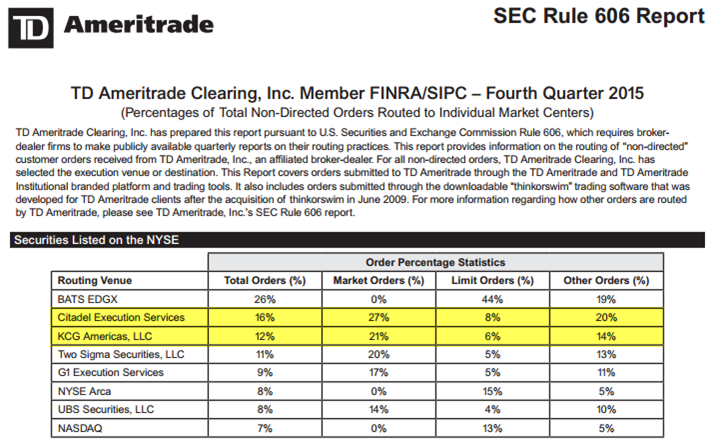

People that follow Jigsaw will know that for years before RobinHood existed, brokerages were selling Order Flow to HFT firms. In fact, some of you will remember this from a 2015 presentation...

I am not trying to single out TD Ameritrade here - but you can see that 48% of non-directed market orders were sent to Citadel and Knight Capital (KCG). These are 2 of the largest HFT firms in the US. Orders that TDA's customers place get sent to an HFT firm who executes them and gets to see them before anyone else in the process. The HFT firms pay the brokerages, which is how brokerages survive.

So yes, I'm afraid it's true - RobinHood was not a charity after all, they just figured they could drop the trading prices to $0 and get more of that HFT money. And they did.

So back to GameStop - a company that's struggling and was heavily shorted by a number of Hedge Funds. Traders on Social Media (it seems to have started at Reddit), decided to bite back. There was a coordinated mass effort on the part of retail traders to buy up GameStop to push up the price to force the Hedge Funds out of their short positions. Price went from up 100% - from the $30's to $396.51. The internet won, Hedge Funds lost. It was a beautiful thing. But then...

RobinHood to the rescue. Steal from the rich and give to the poor, wasn't it?

Well - not quite. Robin Hood suspended buying of GameStop on Thursday, their customers could only sell and not buy. Nobody even knows if a brokerage is legally allowed to do this. The result - the price of GameStop dropped to $132. So RobinHood, a company that has always tried to maintain an image of helping the little guy, stopped the little guy from buying RobinHood. That in turn took the heat off the Hedge Funds and most likely let a lot of them unload their positions.

So that's the 'little guy' put back in his place. The talking heads from the industry are trying really, really hard to frame this as "the little guy needs protecting from himself". Good luck with that.

Even if you side with the little guy (I do) - does it mean shorting is inherently bad?

In Futures, shorting works a little differently. There's a long and short side to every contract - or a buy and a sell side. Nobody says shorting is bad. With stocks, you have to borrow a stock to short it, pay interest and buy it back later (covering). So the mechanics are different but it's really just a way to profit from the opinion that something is going down.

So it boils down to this - if you think something will go up in price you go long, if you think it will go down in price - you go short. That's not evil, that's making a trade based on your opinion.

Many US employers offer a 401k. It's a pension plan where the employee and employer can both contribute. It also allows the employee to control the investment by (amongst other things) buying stocks. There is a massive amount of 401k money in the stock market and is one of the reasons US politicians wear stock prices like a badge of honor. If the stock market goes down, pensions go down. Politicians don't want the market to go down - ever.

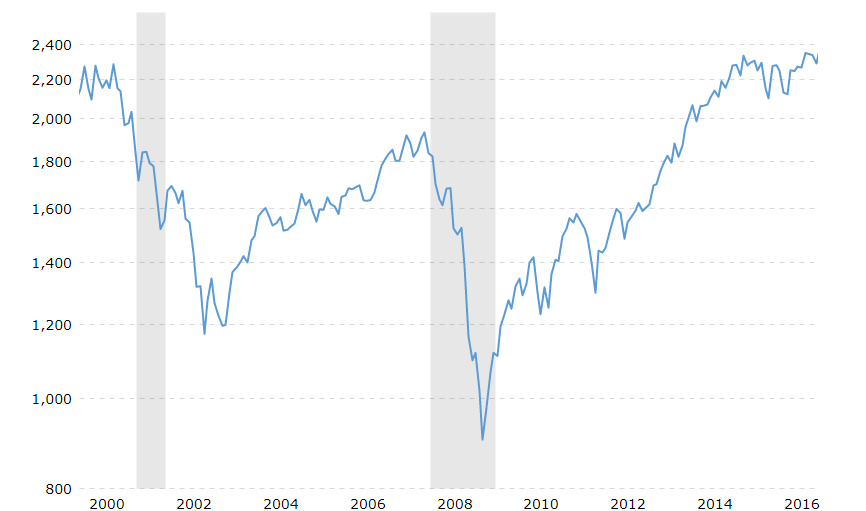

401k holders can only buy stocks, they cannot go short. In my opinion - this creates a perfect storm that would (for example) - see markets at all time highs, when a pandemic is closing a record amount of businesses. This is all fine till we hit an extended bear market or something like this:

S&P500 2000 - > 2016 source: macrotrends.net

The S&P500 was at 2,200 in mid 2000 and didn't reach those levels again till 2015. It took 8 years to bottom out. Imagine having a massive amount of your personal wealth locked into a 401k for that period, watching it drop and not being able to go short.

I get why Elon Musk thinks shorting is bad - it hits him in the pocket. I mean - a lot of shorting could mean he's only worth $100 billion. Elons is like us, he's one of us little guys, right?

But to me - shorting is simply having an opinion that something will go down and putting your money where your mouth is. I think the concept of shorting and then trashing the company on TV is low class - but that's for the big boys.

All traders are making money from correctly guessing the direction of a stock of future? For the life of me, I can't see how one side is good and one side is evil.

I do know one thing - if Mr Regulator makes markets one sided by banning short selling - it'll create more problems than it solves.