The most commonly played areas to trade-off also tend to be those that are the most visually appealing. It should therefore come as no great surprise that the most visually appealing “Support and Resistance” are the ones that are most discussed on trading forums. These are the areas with the highest participation of inexperienced traders.

The problem with entering 'where everybody else is', is that it makes you prime bait for those that are able to push the market around and run your 2 point stop. These people are not fictional, they are very real. If you enter a short at resistance and put your stop just above it, then you are putting yourself in a very precarious position. This article offers some solutions to this issue because in many cases, price will break resistance, reverse and put in a very nice intraday move.

Before going into solutions, it’s worth expanding on the problem. Let’s consider a move up into a resistance area. As you move up to resistance, you have 2 sets of inexperienced traders ready to take a trade. You will have some traders looking to short the resistance level and you will have others looking to play the breakout into new highs. The worst-case scenario for both sets of traders is as follows (consider 1440 as resistance):

The retail traders' perspective

1 – Price moves up to resistance at 1440, some traders get short

2 – Price moves down to 1438.50 other ‘smarter’ traders will jump in, encouraged by the fact that they have confirmation that the level is holding

3 – Price moves up through the resistance area to 1441, breakout traders will get long

4 – Price moves up more ticks through the resistance area to 1442, other ‘smarter’ breakout traders will jump in, encouraged by the fact that they have confirmation that the breakout is true

5 – At the same time, the 1442 level is where the reversal traders had their stops, they bail out buying more contracts

6 – Price now reverses back down through 1440 causing the breakout traders to bail out.

7 – Reversal traders have been bitten at this level and do not take the short second time round.

The BSD perspective

1 – Price moves up to a visually appealing level at 1440. Retail traders will be attracted to this like moths to a flame. Your experience tells you that this market is not one-sided, that this is not a freight train market that is just going to run through the level. You decide that short term, it is worth risking a hundred thousand dollars or so to nudge this market around.

2 – You stack the offers in this market making it look weak. You aren’t expecting the other BSDs to trade against you here; in fact, you expect a few might try to ride your coattails.

3 – With the offers stacked, buy market orders start to dry up. You now know that you are ‘on’

4 – You throw in some sell market orders to nudge the market down. You have limit orders at multiple levels below to buy all the way down to 1438.50. As sellers come in, encouraged by your initial selling, you pick up 1000 or so contracts at each level. As it comes to 1438.50, you stay firm refresh your bids, and pick up another 2000 contracts. You are now long 6000 contracts with an average price of 1439. At the same time, you now put in limit orders to exit the market at 1442.25, 1442.50, 1442.75

5 – You throw in some buy market orders to nudge the market up. Buying begets buying and the market starts popping up. This reaches a crescendo as you get the breakout traders entering and the reversal traders puking out.

6 – You exit the trade with an average price of 1442.50 on your 6000 contracts with a profit of more than $250k for the play.

This does not occur at every support/resistance level. It doesn’t occur every day. The numbers of contracts, the numbers of ticks gained may vary but this is a game that is played on a regular basis. If you’ve ever heard of Paul Rotter, AKA The Flipper – this is one of the games people like him, play.

On the surface, it may appear rather unsportsmanlike, a little unfair perhaps. This sort of activity is known as ‘gaming the market’. The name comes from ‘Game Theory’. Whilst it is beyond the scope of this article to describe the ins and outs of Game Theory, suffice to say that if people were not so predictable, it would not be possible to game them.

If you put the above to one side and look at the price action surrounding Support & Resistance (still from a day traders perspective). There are still issues.

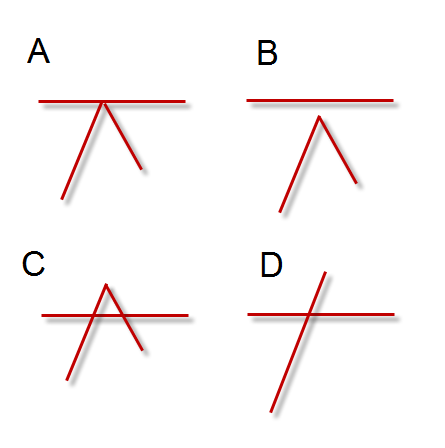

Image 1 - Resistance Levels

This diagram is a simplified example of what occurs at a level of resistance.

A – Price reverses off the level

B – Price falls short of the level and reverses

C – Price pops through the level and reverses

D – Price moves through the level and carries on

Effectively, you have scenarios A-C where there is the potential to make money from the reversal and scenario D where you’d lose money. In scenario A, the best price you can expect is 1 tick below the level itself. A limit order to sell the level will probably remain unfilled. So what is it you do here? Based on game theory, we don’t want to be too predictable. A stop 2 points above the level is absolutely asking for trouble. On the other hand, if you want to participate in a lot of reversals, you might be inclined to enter the market 2 points below the level. So what is the answer? Enter 2 points below the level and have a stop 4 points above it? A 6 point stop on a day trade? You’d sure have to be right a lot.

Possible Solutions

There are, of course, solutions to these issues.

The easiest change to make is to stop playing these levels altogether. You could change your perspective from playing reversals off levels to using a reversal of a level to set your bias. So, if the market is moving up, stay long-biased. Consider down moves as short-term corrections. When price reverses off a resistance level, then change your bias to short. If you then look to play pullbacks off the new direction, you’ll be entering the market in a less crowded space, looking to play off a liquidity vacuum. This is of course a lower risk but lower reward proposition.

Know Thy Market

Knowing the market more intimately will also help prevent you from jumping in front of a move that will not stop. After trading the ES on a daily basis, I often know right from the open if it will be a slow day or not. I also have a good feel for the reaction to the various news events and whether it’s likely a slow start because of a 10 am economic news release. Slower days have a much higher chance of bouncing off a key support/resistance level. On a really slow day, you might see the market bounce off the same range extremes 3 or 4 times. The problem with this is that the more often it bounces off a level, the more stops build up on the other side of the range and the more confident the inexperienced traders are to take a bounce off the level. With this occurring on slow, lower volume days, it is also on a day where the Flippers of the world have a much higher chance of being successful at a bit of gameplay. If you miss the early hits of the range, it’s best to forget it.

There’s the regular days – ones where the market puts in 3-4 tradeable 8+ point moves and ends the day pretty much where it started both in terms of price AND cumulative delta. You have higher participation but again, this is purely intra-day speculation. A game of ping pong between extremes where the market hoovers up weak hands as it bounces from one level to the next. These days are also fairly good for bounces off levels but the market is going to be nudged around.

Then there are the higher volume days where the market is going to run, maybe because of the date, because of news but basically, because short-term speculators are not in charge. These are the days when you really do not want to be fading levels.

Developing a feel for a market is a long-term proposition. Playing off prior swing highs/lows is so simple a monkey could do it.

Order Flow

An experienced order flow practitioner will be able to nail a lot of resistance points within a few ticks. This does not happen in isolation though and these people are not without losing trades. If you can’t cut a losing trade without prejudice as soon as you know it’s a loser, then there’s no point trying to use the order flow. People that use order flow are not just switching on a DOM at the start of the day and just trading off the bids and offers. You need to know where you are in the grand scheme of things. Someone using order flow would not ignore the 1 year high being 3 ticks above, they would not ignore the news announcements.

Whilst using the order flow does take practice, there are a few things you can look for right now that will help you along.

First of all, does the market even agree with you that this is a significant resistance level? There’s no point playing a level if you are the only person looking at it, is there? At any major resistance level, you will see the volume of the offers much greater than the volume of the bids:

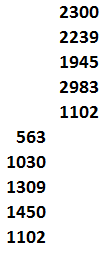

Image 2 - Market Depth

Seeing large quantities on the offer side does not mean a reversal will take place. It just means that there are lots of people watching that level. Those offers could be fake which takes you to the second thing; how are the offers reacting to trades hitting into them? In the above example we have 1102 offered, what happens when buy market orders start trading against those offers? Do they pull out of the way? Do the offers stay firm and more offers get added at that level? If people pull the orders, it doesn’t mean price will not reverse but it means it probably has some more room to the upside until it does reverse.

Similarly, what is happening on the bid side there? If the bidders are pulling out of the way when market sell orders hit them, then it is good for the downside.

Of course, when looking at how the bids & offers react to market sell & buy orders, we also need to consider how aggressive those placing market orders are. If only sellers are placing market orders aggressively, there’s no way the buyers will push it up.

Finally, let’s say you do place your reversal trade. The prime entry signal is having a price to lean on. Not all reversals are like this but many are. You will move up to a price where the offers stay firm. Buy market orders continue lifting (trading into) that offer but price doesn’t move up. That’s a line in the sand, a backstop against which you can enter a short trade. If you short at a good location where the offers firmed up and absorbed the buying, you can probably get 2-3 ticks onside fairly easily. Now you be wary of the flip. The 2 key things you need to look out for on the flip are:

1 – Large quantities of sell market orders hitting the bids. This may seem a bit odd, if you have lots of sell orders, then surely it is indicative of a successful reversal? Let’s say you move up towards resistance and you see on average 500-600 contracts hitting into each offer to make it tick up. So you see 500 contracts hit the offer at 1441, it ticks up, then 650 hit the offer at 1441.25 and it ticks up this continues until the top where maybe 3000 contracts hit because it’s being held by an aggressive offer. As it moves down, you see 900 contracts hit into the bid at 1442. It ticks down, then 1000 contracts hit the bid at 1441.75 and it ticks down again, then you see 950 hit the bid at 1441.50 and again it ticks down. It is taking more contracts to tick the market down than it took to tick the market up. This ‘thickening’ is indicative of somebody slowly absorbing the selling as it ticks down. The time to worry about this is in the first 8 ticks or so of the reversal, the reason being that they want to game the reversal traders but to do that they need a controlled descent. If they let it go down too far, then too many people will jump in with shorts.

2 – Icebergs. There’s a lot of mystique about icebergs and to be honest, they have very little impact on the market most of the time. An iceberg is simply refreshing of limit orders on the inside bid or offer. For example, we might have 500 bid and 100 sell market orders hit that bid, but we continue to see 500 bid. What is happening here is a fairly simple program that is refreshing the bid to keep it ‘topped up’ as trades hit into it. The idea of course is to hide the true demand (or supply). When a flip is occurring, at some point the bidders will need to step up and stop the market. If you know this, it’s easy enough to see. In fact, they could just put up a bid of 10,000 contracts. The thing is, whilst it is easy enough to see when you know what you are looking for, most people don’t know what they are looking for. They put up a bid for 500-1000 contracts and just refresh it because of the amount of people that will continue to sell into it. They want people to continue selling because the more contracts they buy, the more money they will make. If they put up a huge bid, people will front run it and they’ll end up with fewer contracts after taking all the risk. Note that these icebergs aren’t perfect. If the level is set to maintain a bid of 500 contracts, then someone can still put in a sell market order for 1000 contracts and price WILL tick down momentarily. It will tick back up fairly quickly if someone is attempting to hold the market. I mention this because you might think you can enter at the iceberg level and put a stop 1 tick behind it.

Once you are in and have your 2-3 ticks cushion, you need to get clear by 8 ticks or so before you can relax a little. Up to that point, you need to be ready to cut the trade the moment it looks like the area is being gamed.

Summary

Trading Support and Resistance has allure because it looks so simple. You really could get a monkey to trade it (although not profitably). If you look back on a chart historically with your rose-tinted glasses on, you will see all the levels that held because they stand out much more than those that don’t hold. On the right edge, it’s not as clean.

If you can identify that the day is right for trading a reversal and you can identify that the order flow is on your side, then you will have a much higher success rate.

Note that this is not a competition to get in as close to the reversal point as possible. It’s always a balance between a good price and some degree of confirmation. There is NOTHING wrong with entering a trade ‘late’ if that is what is most profitable for you. A more aggressive approach might give you a few ticks more profit but produce more losers.